Connecticut Solar Panel Incentives

Solar incentives rebates and tax credits available in connecticut in 2020.

Connecticut solar panel incentives. The most significant incentive to install solar panels for homes and businesses is the federal solar tax credit. Up to 0 46. Federal solar tax. Energy conservation loan program.

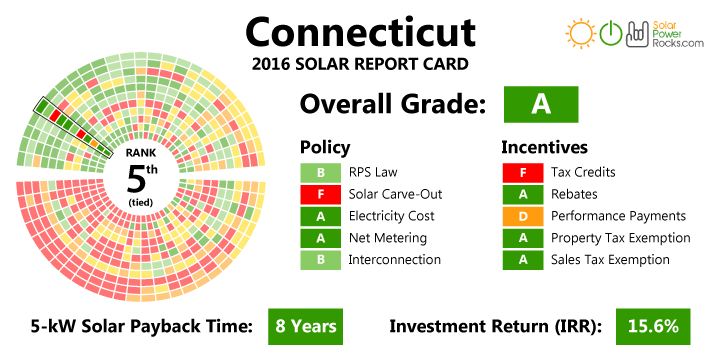

Connecticut solar incentives rebates and tax credits. Residential solar investment programs. The estimated savings for the average homeowner in connecticut per year are 1 437 or around 120 per month. Tax exemptions for renewable energy equipment.

At the end of 2020 the amount of the credit will decrease from 26 to 22 of the cost of the solar installation. Officially known as the residential solar investment program and administered by the connecticut green bank this rebate is. Going solar in connecticut allows residents to save a significant amount on their energy bills while earning money back through federal tax incentives. Those incentives are paid for by the utility companies and will be through 2022.

Residential solar investment program. Sales and property tax exemptions. The rps also works hand in hand with the connecticut green bank s residential solar investment program which offers incentives to homeowners who install solar panels.