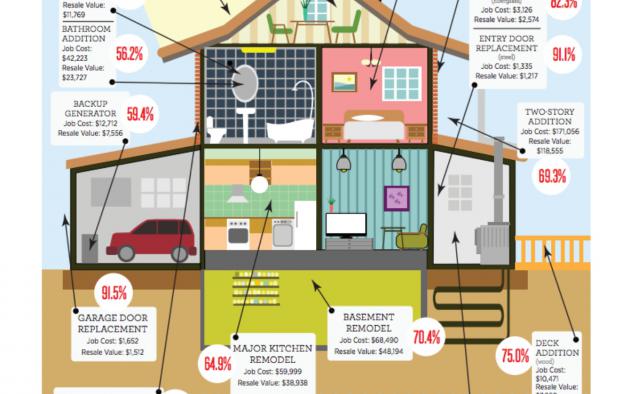

Deduct Attic Insulation

Anything that reduces air loss weather stripping or caulk can also qualify if you possess a certification statement from the manufacturer.

Deduct attic insulation. Home insulation bulk insulation products may also qualify for a tax credit if they meet energy star standards. Part of an addition project but additional insulation in attic and craw. You can claim 10 of the cost with a maximum limit of 500. However if this is a capital improvement you will be able to add the cost of the improvement to the basis in your home.

In the search box search for energy improvements. These are entered in the deductions credits section. Over 90 percent of us homes are improperly insulated. For example you can get a tax credit if you purchase insulation materials for your walls or attic.

Despite this it s easy to overlook the benefits of proper attic ventilation radiant barriers and energy efficient insulation. For insulation you can get a tax credit of 10 of the cost up to 500. If you re looking to improve your energy use check out these five different ways to make your attic more energy efficient. Unfortunately no you will not be able to deduct the costs for repairs.

I have attached a turbotax faq with more information. Several insulation and sealant products qualify for a tax credit. Don t search for energy credit as this will take you to the wrong place in the program. 10 of the cost up to 500 requirements typical bulk insulation products can qualify such as batts rolls blow in fibers rigid boards expanding spray and pour in place.

Standard bulk rolls of insulation spray foam type insulation and liquid to solid pour in place insulation count toward the credit.